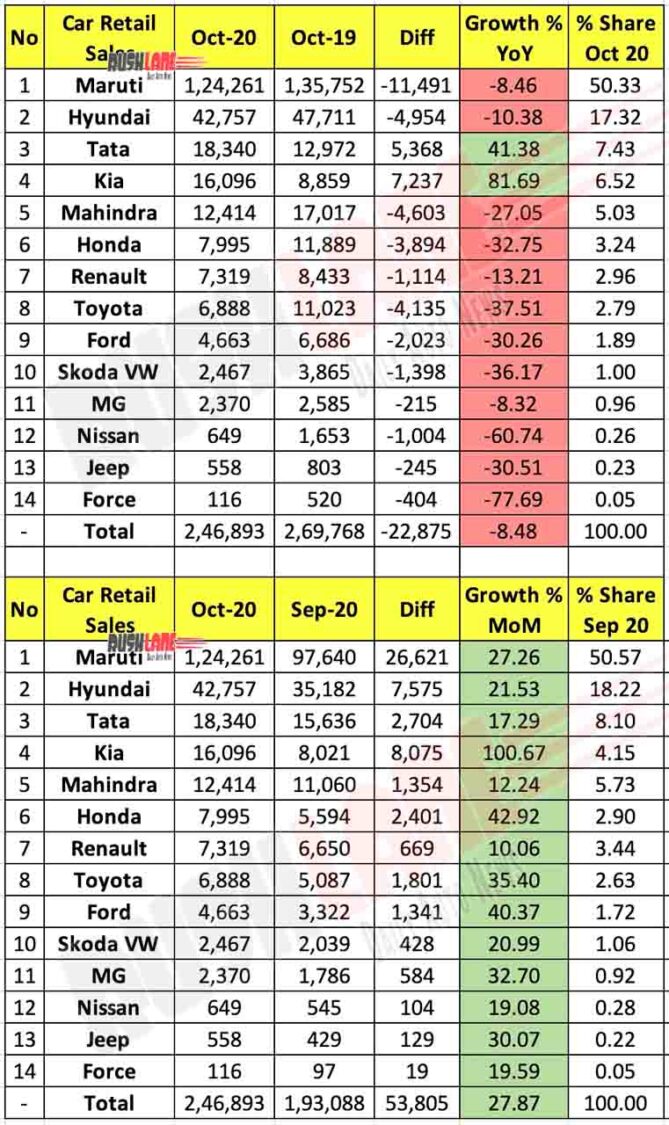

The OEMs noted an 8.48 percent YoY de-growth but a 27.87 percent MoM growth

As per figures of retail sales as released by Federation of Automobile Dealers Associations (FADA), sales for all brands increased significantly in October 2020 over that of Sept 20. However, every automaker noted de-growth in terms of YoY sales in October 2020, with the exception of Tata and Kia.

Here we talk about retail sales. It may be noted that there is a difference between retail and whole sales. Retail sales include those cars sold to customer via dealer while wholesales are those cars sold from company to dealer. Whole sales report for Oct 2020 can be found here.

All Register Decline – Except Tata and Kia

Maruti Suzuki reported a YoY de-growth of 8.46 percent to 1,24,261 units sold in October 2020, as against 1,35,752 units sold in October 2019. MoM sales however, increased 27.26 percent as against 97,640 units sold in Sept 20. Maruti Suzuki held on to its market share of above 50 percent at 50.33 percent. The company’s bestselling models included the Swift, Baleno, Wagon R, Alto, Dzire, Eeco, Brezza, S-Presso and Celerio in that order.

Hyundai noted a YoY de-growth of 10.38 percent to 42,757 unit retail sales in the past month as compared to 47,711 units sold in the same period of the previous year. MoM sales increased 21.53 percent from 35,182 units sold in Sept 20. Thanks to these sales, the company currently holds a market share of 18.22 percent.

Tata Motors and Kia Motors have noted increased retail sales growth both in terms of YoY and MoM sales. Tata sales stood at 18,340 units in October 2020 as compared to 12,972 units sold in October 2019 while Sept 20 sales were at 15,636 units. The Tiago, Altroz and Nexon continued to be the company’s bestselling models for Oct 2020.

Mahindra noted a 27.05 percent dip in sales in October 2020 to 12,414 units, down from 17,017 units sold in October 2019. However, MoM sales fared better with 11,060 units sold in Sept 20. The company has commenced deliveries of the new Thar and the company now looks ahead to the launch of the new XUV500 which is currently spied numerous times while on test.

| No | Car Retail Sales | Oct-20 | Oct-19 |

|---|---|---|---|

| 1 | Maruti | 1,24,261 | 1,35,752 |

| 2 | Hyundai | 42,757 | 47,711 |

| 3 | Tata | 18,340 | 12,972 |

| 4 | Kia | 16,096 | 8,859 |

| 5 | Mahindra | 12,414 | 17,017 |

| 6 | Honda | 7,995 | 11,889 |

| 7 | Renault | 7,319 | 8,433 |

| 8 | Toyota | 6,888 | 11,023 |

| 9 | Ford | 4,663 | 6,686 |

| 10 | Skoda VW | 2,467 | 3,865 |

| 11 | MG | 2,370 | 2,585 |

| 12 | Nissan | 649 | 1,653 |

| 13 | Jeep | 558 | 803 |

| 14 | Force | 116 | 520 |

| – | Total | 2,46,893 | 2,69,768 |

Honda Cars India which noted a 32.75 percent YoY decline to 7,995 units sold in October 2020 as against 11,889 units sold in Oct 19, noted a 42.92 percent MoM growth as against 5,594 units sold in Sept 19. Renault, Toyota, Ford, Skoda and MG Motors all noted de-growth in terms of YoY sales but more positive MoM sales, as did Nissan, Jeep and Force Motors.

Retail sales figures of each of these automakers have indicated that there is a turn of events in the auto segment in India since the past two months, with buyers coming out of the ill effects of the lockdown and shut down seen in the early months of this year and eager to celebrate the festive season despite dampers of a lower economy and job insecurities. Hefty festive discounts and the need for personal means of travel have been contributing factors to increased MoM sales while a certain degree of cautiousness still prevails over fears of a second wave of the COVID-19 pandemic in the country.

Disclaimer – Above numbers do not include data from Andhra Pradesh, Madhya Pradesh, Lakshadweep & Telangana as all these States/UT’s are not yet on Vahan 4. The data has been gathered by FADA from 1,257 RTOs; out of 1,464 RTOs